37+ Paycheck Calculator West Virginia

Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross.

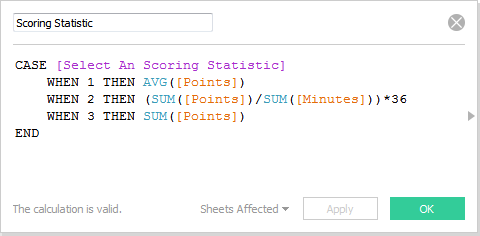

Tableau Deep Dive Parameters Calculated Fields Interworks

6 to 30 characters long.

. The current tax rates are 0 10 12 22 24 32 35 or 37. Married Filing Jointly or Widower 0 20550. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes.

Use PaycheckCitys dual scenario salary paycheck calculator to compare two salary paycheck scenarios and see the difference in taxes and net pay. Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. Again the percentage chosen is based on the paycheck amount and your W4 answers.

The percentage method is used if your bonus comes in a separate check from your regular paycheck. The lists do not show all contributions to every state ballot measure or each independent expenditure committee formed to support or. Our paycheck calculator is a free on-line service and is available to everyone.

Your employer withholds a flat 22 or 37 if over 1 million. In our calculator we take your home value and multiply that by your countys effective property tax rate. How to Fill Out W-4.

The less taxable income you have the lower the federal income tax rates you are subject to. It determines the amount of gross wages before taxes and deductions that are withheld given a. There are a total of 53 General Schedule Locality Areas which were established by the GSAs Office of Personnel Management to allow the General Schedule Payscale and the LEO Payscale which also uses these localities to be adjusted for the varying cost-of-living across different parts of the United States.

Below are lists of the top 10 contributors to committees that have raised at least 1000000 and are primarily formed to support or oppose a state ballot measure or a candidate for state office in the November 2022 general election. In our calculator we take your home value and multiply that by your countys effective property tax rate. 180 15 years in 52730.

Microsoft describes the CMAs concerns as misplaced and says that. Assumes Median US. Taxpayers are not charged a single rate on all of their taxable.

Tax system is progressive. Household has an annual income of 63218 mean third quintile US. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

This is equal to the median property tax paid as a percentage of the median home value in your county. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Select your state from the list below to see its salary paycheck calculatorAlabama.

The more taxable income you have the higher federal income tax rate you are subject to. This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

The federal income tax system is progressive so the rate of taxation increases as income increases. The current tax rates are 0 10 12 22 24 32 35 or 37. And spends annually an amount equal to the spending of a household earning the median US.

Each Locality Area has a Locality Pay Adjustment percentage updated. Figure out your filing status. This calculator will take a gross pay and calculate the net pay which is the employees take-home pay.

This percentage method is also used for other supplemental income such as severance pay commissions overtime etc. Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. Since the state and local income tax deduction or SALT deduction is limited now to 10000 for joint filers doctors in high tax states like.

Its average effective property tax rate of 057 is the ninth-lowest state rate in the US as comes in at about half of the national average. Use this Virginia gross pay calculator to gross up wages based on net pay. This is equal to the median property tax paid as a percentage of the median home value in your county.

Marginal tax rates range from 10 to 37. You can add multiple rates. No personal information is collected.

Again the percentage chosen is based on the paycheck amount and your W4 answers. Neither the companys board nor management have contributed a dime to this lobbying effort so far. Again the percentage chosen is based on the paycheck amount and your W4 answers.

How is an employees Social Security and Medicare taxes calculated. The state however would be required to raise up to 5bn a year in new taxes. Work out your adjusted gross income.

Gross pay amount is earnings before taxes and deductions are withheld by the employer. Must contain at least 4 different symbols. Illinois has a total of 620049 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration.

These rates are 10 12 22 24 32 35 37. There is no state-level standard deductions. Supplemental wages are still taxed Social Security Medicare and.

Owns a car valued at 25295 the highest-selling car of 2021. Income in America is taxed by the federal government most state governments and many local governments. West Virginia has some of the lowest property tax rates in the country.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. This table shows the top 5 industries in Illinois by number of loans awarded with average loan amounts and number of jobs reported. The current tax rates are 0 10 12 22 24 32 35 or 37.

In this way the US. Physicians in certain states will pay more. Enter your financial details to calculate your taxes.

ASCII characters only characters found on a standard US keyboard. Again the percentage chosen is based on the paycheck amount and your W4 answers. Owns a home valued at 217500 median US.

How is an employees Social Security and Medicare taxes calculated. The current tax rates are 0 10 12 22 24 32 35 or 37.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Homes Houses For Sale In Berryville Va Byowner Com

Busorgs Chasalow Outline Flowcharts Pdf Law Of Agency Partnership

January 2017 Dnaexplained Genetic Genealogy

.jpg?crop=%280%2C0%2C300%2C163%29&cropxunits=300&cropyunits=163&width=350&mode=pad&bgcolor=333333&quality=80)

University Square Apartment Community 2615 S University Dr Fargo Nd Rentcafe

Free Paycheck Calculator Hourly Salary Usa Dremployee

West Virginia Paycheck Calculator Tax Year 2022

West Virginia Paycheck Calculator Adp

Paycheck Calculator Salaried Employees Primepay

River Trace Apartments And Homes 2710 River Trace Circle Bradenton Fl Rentcafe

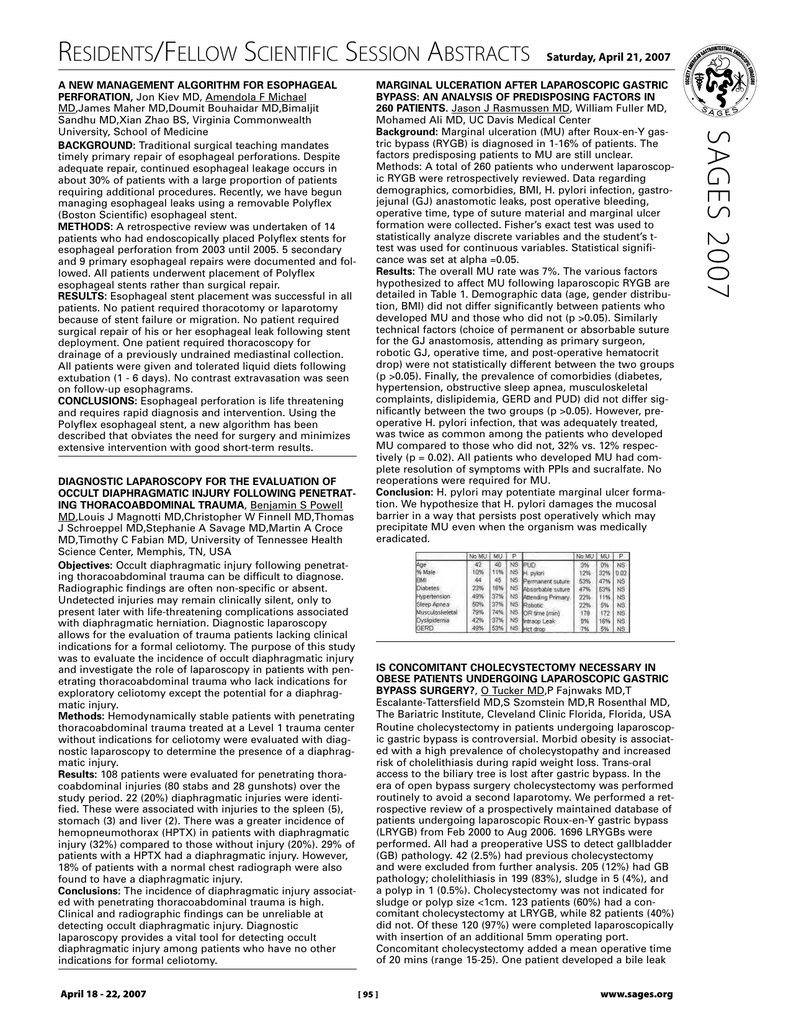

Link Sages

Free Paycheck Calculator Hourly Salary Take Home After Taxes

4789 Louise Rd Cumberland Furnace Tn 37051 52 Photos Mls 2458737 Movoto

Minnesota Paycheck Calculator Smartasset

West Virginia Income Tax Calculator Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Barrington North Apartments 104 112 Wedgewood Drive Morgantown Wv Rentcafe